August 23rd, 2024

While a real estate background check based on an individual's name will help with the safety-related aspects of the tenant selection process, it can't tell you much about their financial capacity. Hence, many landlords require applicants to provide proof of income through official pay stubs or federal tax documents. This step should establish the applicant's ability to pay the rent. However, income alone is not the complete picture—what if all earnings service debt? Potential tenants may not have the amount of available income their pay stubs indicate.

With that in mind, it makes sense for a landlord to check an applicant's credit history before finalizing a rental application. Any landlord who checks credit must follow specific rules while obtaining information from the tenant, including their Social Security number. Why do landlords need to collect such sensitive data during this process? Let's explore the adequate financial vetting of prospective tenants more.

What Information Do You Need to Run a Credit Check?

With the typical background check, you often only need an individual's name and other information about them to search for criminal records. However, a credit check is somewhat different—landlords must collect an applicant's Social Security number to move forward. Some background checks, such as alias verification, already require using an SSN to find matches—but you can't find someone's credit report without their SSN. Why?

Simply put, there is no other way to identify an individual in the United States. Social Security numbers are unique identifiers assigned by the government that individuals possess for their entire life. It is this number that the primary credit reporting agencies use to associate an individual's credit file with their history. Therefore, you must collect an SSN to be sure you've extracted the correct credit file for review.

Although no federal law requires landlords to obtain an applicant's consent before ordering a credit report, many property managers prefer to do so. Taking care in collecting this information ensures that its purpose—for making a housing-related decision—is clear. To simplify the effort, landlords can disclose their intent to use a credit check and obtain an applicant's consent on their rental application form.

Why Check a Tenant's Credit? 3 Key Reasons to Know

What makes collecting more personal information from applicants worth the effort? Although an individual's credit report can't tell the whole story, the numbers it contains may illuminate the decision-making process. It could be a clear report, full of red flags, or concerning enough that you require an additional conversation with the applicant. There are three reasons to consider:

First, you should be able to see whether a potential tenant has substantial debt. Owing several creditors could indicate financial irresponsibility or less pressing issues. For example, it is ubiquitous for Americans to have considerable medical debts. As of 2023, medical debts in collections worth $500 or less ceased to appear on credit reports.

Second, you can see whether an applicant has a good history of making timely payments. Missed and late payments appear on credit reports and can help you better understand whether applicants are trustworthy and honor their financial obligations.

Finally, you can see if the individual has any prior evictions in their credit report. Some landlords will choose to steer clear of those with evictions, especially more than one since it could indicate a habitual inability to honor the conditions of rental agreements. If landlords discover evictions on a credit report, they should consider discussing it with the applicant.

Handling Personal Information Vs. Using a Third-Party Service

Demanding Social Security numbers from applicants can make some landlords uncomfortable. Once obtained, you're responsible for protecting and keeping them secure. Exposing SSNs and other personal information can open the door to identity theft and other issues. If you intend to collect SSNs and order reports yourself, develop a policy for storage and handling. You may need to destroy your record of an applicant's SSN rather than keep such information accessible.

Some third-party services will contact your applicant, letting them order their credit report while authorizing you to receive a copy. This streamlined process ensures you don't need to manage SSNs directly. Choosing a partner who understands the importance of security and intelligent handling practices for personal data can make your tenant selection process much more manageable.

Warning Signs on Credit Reports

Once you receive a copy of the credit report, you'll need to know how to analyze it. Reports from the three primary credit reporting bureaus typically include the same information. This data includes open accounts, the maximum credit line, and the amount of credit currently utilized. What are the red flags to look for in this information?

A high degree of utilization versus total credit

A habit of missing payments

Accounts in arrears or sent to collections

Evictions

Many credit lines

Many new credit lines

You should evaluate the report for signs that indicate an applicant may not make sound financial decisions. You should consider this information in concert with the income they report on the rental application. Though most landlords only accept applicants whose take-home pay is three times or more the amount of rent, you should evaluate tenants based on your own risk tolerance.

Simplifying and Streamlining Your Real Estate Background Check Process

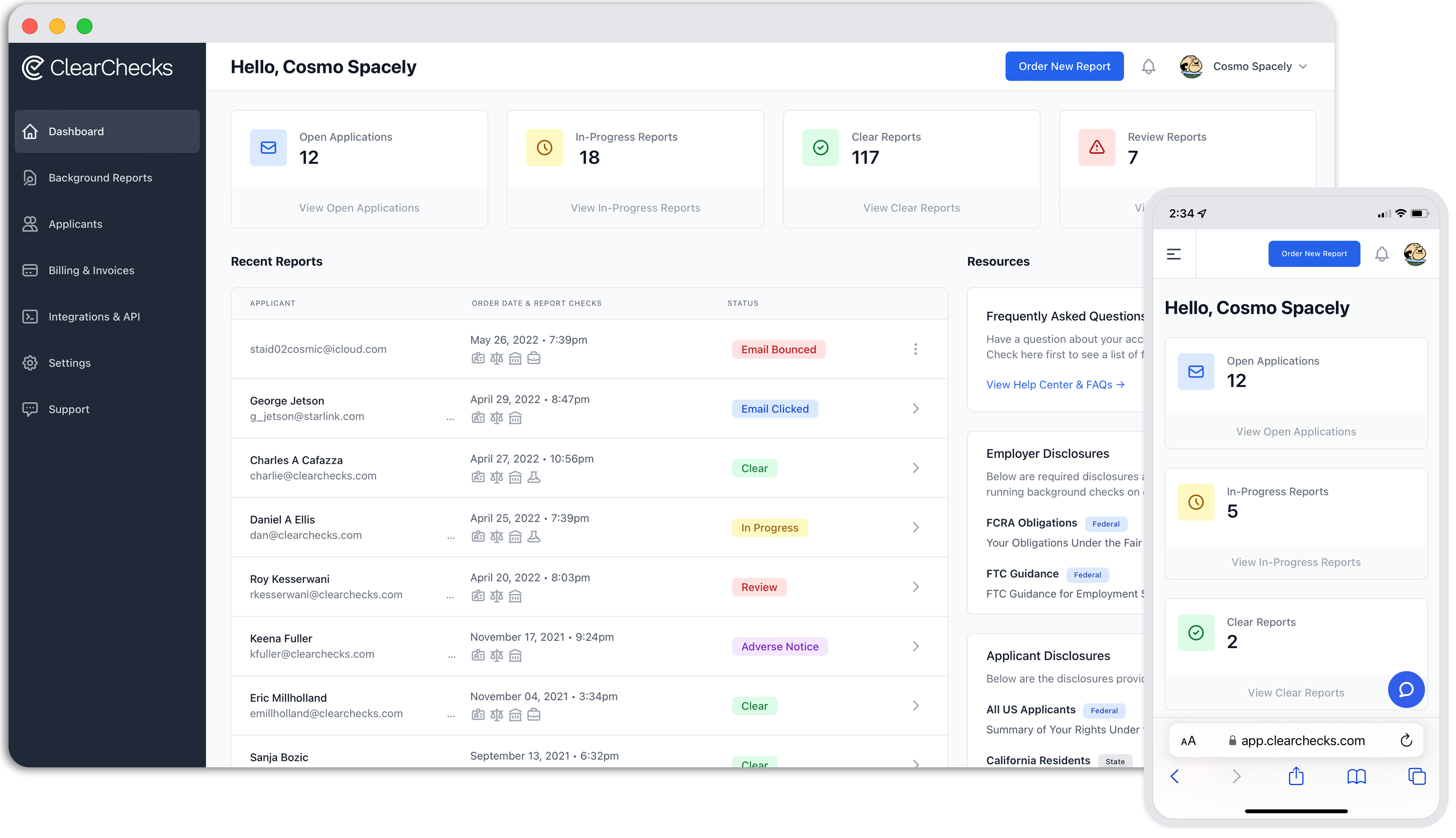

Considering the importance of a credit report to the tenant selection process, it's easy to see that you'll need to build a workflow that nets relevant information without delays. Many landlords, especially those with only one property, may try to handle the process independently. However, it can be time-consuming and frustrating. The solution is to work with a third-party consumer reporting company.

The right partner agency can help you with everything from questions such as "How far back does a real estate background check go?" to concerns about how to keep your vetting process fast to meet deadlines.

Need Background Checks?

See packages and pricing and order instantly.

National, County, Statewide, Federal Criminal Searches

Motor Vehicle Records

Employment & Education Verifications

Bankruptcies, Liens, & Judgments

Drug Testing

Hospitality Hiring Guide: Background Checks for Hotels & Restaurants

TruthFinder Review: The Real Risks of Using People-Search Sites

BeenVerified Review: What “Been Verified” Really Means (and What It Doesn’t)

Scaling Starts with People: How McDonald’s Develops Talent and High-Performing Franchise Operators

Keeping Volunteer Organizations Safe During the Holiday Season

Why We Require Social Security Numbers: A Case for Accuracy in Background Checks

A Note from ClearChecks on HireRight Acquisition & New BackgroundChecks.com