September 27th, 2023

The Fair Credit Reporting Act is one of the most fundamental legislation governing the hiring process today. Because so many employers use background checks, FCRA compliance is not negotiable. The same applies to others who frequently use background checks, such as landlords or non-profit organizations. Complying with the FCRA ensures you receive more reliable information and respect applicants’ rights. The law intends to protect consumers from inaccurate or unfair reporting practices.

Compliance is usually a concern when gaining an applicant’s consent or providing notice. However, those using consumer reports should not use a provider that operates beyond the boundaries of the law. Doing so could ultimately expose your company to the risk of accusations of discrimination or unfair hiring practices.

A recent case in California highlights the risks. The FTC levied nearly $6 million in punitive fines against two companies, TruthFinder and Instant Checkmate, for repeatedly violating the FCRA.

How Did the Companies Violate FCRA Requirements?

According to the FTC, both companies operated as consumer reporting agencies despite using language that differentiated them from such services. The FTC says that the companies did not attempt to determine if anyone ordering background checks on others had a reason to do so. In other words, private individuals could easily request records for anyone without legal purpose. Both organizations also misrepresented records in advertising, often claiming that a subject had a serious record while the actual trespass could be a simple traffic ticket.

The FTC charged the companies, stating that neither attempted to determine the accuracy of its records. Their reports often contained inaccurate information, and the companies were often non-responsive to individuals seeking to correct their records. Both companies must now operate under compliance-related court orders and millions in fines.

Employers and Others Must Choose Screening Services With Care

When hiring, businesses must operate with all the facts, especially in sensitive positions such as education, child care, or law enforcement. Using a background check provider that does not strive for accuracy or reliability puts you at risk of non-compliance. Before you sign screening agreements with them, vetting companies is essential to protect your business and job applicants.

How backgroundchecks.com Meets FCRA Compliance Requirements

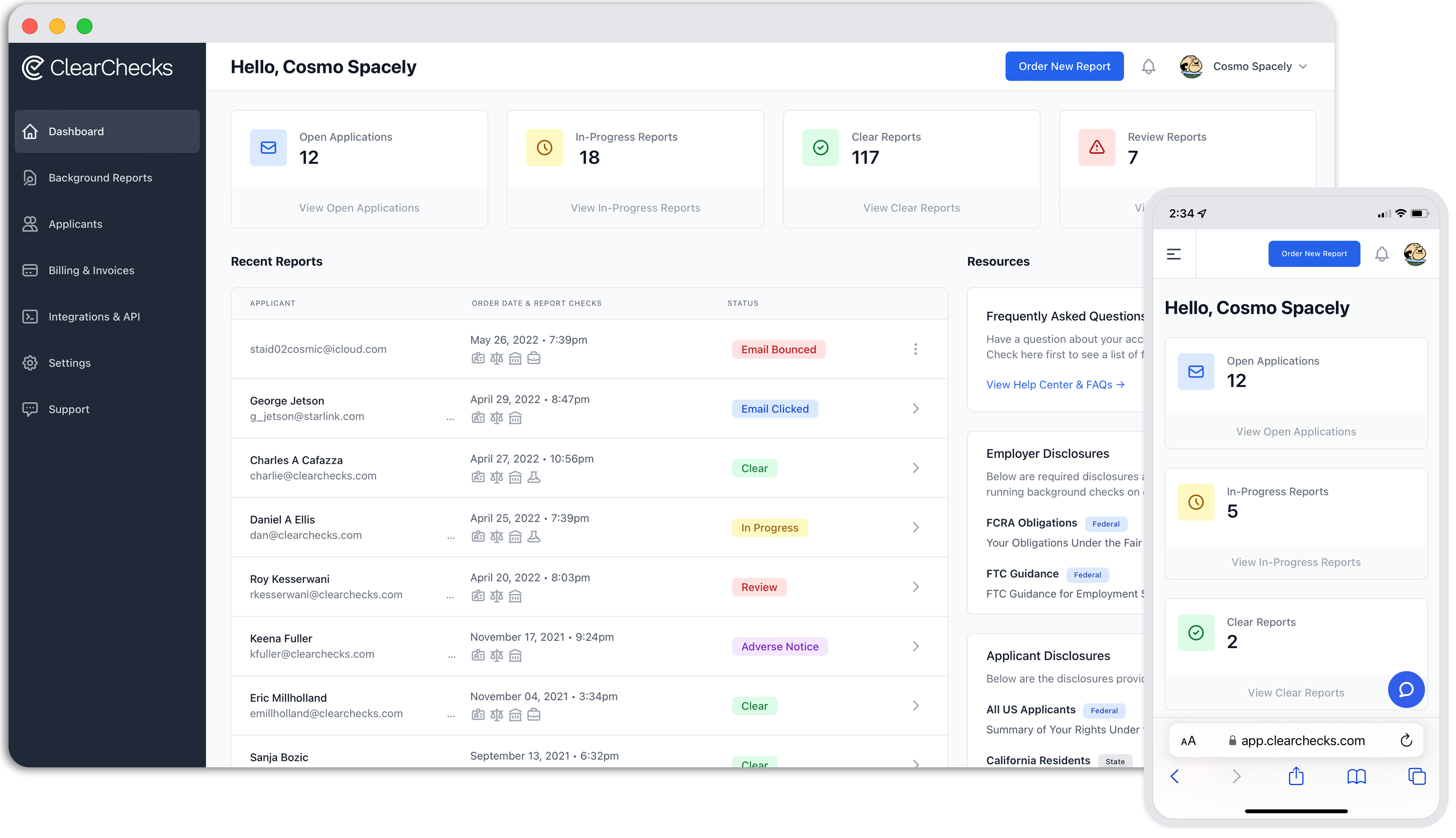

Finding an FCRA-compliant criminal background check doesn’t have to be challenging. Carefully consider how a company structures its offerings and how much they have to offer about creating compliant processes. At backgroundchecks.com, for example, we’ve built compliance directly into many of our workflows. Consider our applicant self-entry program, which lets companies direct individuals to submit their information for vetting.

We ask candidates if they’ve received your disclosure and consent forms during the workflow. We provide boilerplate versions that cover your compliance requirements if they have not. Look for such efforts in a partner—a proactive attitude towards ensuring your business has met its obligations.

We also provide extensive knowledge base articles about the Fair Credit Reporting Act and everything you need to know. Rather than relying on companies that have already received multiple warnings and fines from the FTC, seek a partner that understands the law, follows it closely, and helps your business do the same.

Need Background Checks?

See packages and pricing and order instantly.

National, County, Statewide, Federal Criminal Searches

Motor Vehicle Records

Employment & Education Verifications

Bankruptcies, Liens, & Judgments

Drug Testing

Hospitality Hiring Guide: Background Checks for Hotels & Restaurants

TruthFinder Review: The Real Risks of Using People-Search Sites

BeenVerified Review: What “Been Verified” Really Means (and What It Doesn’t)

Scaling Starts with People: How McDonald’s Develops Talent and High-Performing Franchise Operators

Keeping Volunteer Organizations Safe During the Holiday Season

Why We Require Social Security Numbers: A Case for Accuracy in Background Checks

A Note from ClearChecks on HireRight Acquisition & New BackgroundChecks.com