Hospitality Hiring Guide: Background Checks for Hotels & Restaurants

September 10th, 2020

Are you using our background checks for employment purposes? If so, then you are legally required to follow the requirements of the Fair Credit Reporting Act (FCRA). This federal law protects the privacy and rights of the subjects of consumer reports. Background checks used for employment purposes qualify as consumer reports under the law. As such, they are subject to the FCRA. The FCRA applies to employers and consumer reporting agencies, or CRAs. FCRA compliance is critical for businesses.

Note that “employment purposes” include more than just part-time or full-time employees. The FCRA also applies when selecting contractors, temporary workers, volunteers, and others. Whenever you use a background check to vet someone for these positions, the FCRA applies. Read on for a guide to the major FCRA requirements you must know and follow.

What is the FCRA?

The Fair Credit Reporting Act, or FCRA, became law in 1971. The goal: ensure that consumer reporting agencies acted with greater fairness. The FCRA aimed to create greater impartiality and respect for the consumer’s right to privacy. The FCRA protects the subject of a check by limiting what a CRA can report.

Despite its name, the law goes beyond credit reports. Today, the law replies to any kind of consumer report that includes the following:

Information about someone’s character

Someone’s reputation

Mode of living

Criminal records, and so on.

The FCRA applies whenever this information determines credit, insurance, or job eligibility. Background check agencies fall under the law because they provide reports for employment purposes.

FCRA Disclosure Requirements

Within FCRA regulations, there are several rules about what agencies can report. For instance, bankruptcy cases can be no older than ten years. Other adverse information, such as civil judgments, can last seven years. The only exceptions are criminal conviction records. Unless expunged, criminal convictions can appear on a background check report indefinitely. No medical information should appear on consumer reports unless the report is for insurance.

The FCRA also requires employers to disclose when they plan to use consumer reports. Businesses must always get an individual’s consent to such a check. In this way, the FCRA protects consumers before, during, and after screening.

Let’s look more closely at those stages.

Before using our services

You should understand the relationship of the FCRA to background check processes. Because this law governs so much of the hiring process, you can’t afford to overlook it. The Consumer Financial Protection Bureau has many helpful tools in this area. Before conducting a background check, you should read the CFPB’s “Notice to Users of Consumer Reports.” This document helps support FCRA-compliant background check procedures. Here’s what else you should know.

The first steps of the FCRA background screening process are straightforward. Both the employer and job applicants have some steps to take.

First, as the employer, you must give the applicant a disclosure form. The informs the applicant that you will check their record for employment purposes. This disclosure must be separate from any other documents. For instance, you cannot bundle the disclosure with your employment application. Likewise, you can’t hide it alongside a release of liability. The courts are clear on this subject. The disclosure must be truly “standalone.”

Second, the applicant must sign an electronic or written authorization form. This authorizes the employer to run a background check. Similar to the disclosure form, the consent form should be distinct from other application documents.

The FCRA permits the combination of the disclosure form and the authorization form. You can choose to present them separately if desired. If you do decide to combine the two documents, you cannot add any more information. The combined form should only contain the disclosure and authorization.

One test for whether the form is FCRA compliant is to check whether each sentence can begin with either “We hereby disclose to you that ...” or “You hereby authorize us to ...”. If not, you may have too much extra information. This might threaten its FCRA compliance. Always consult with legal counsel to prepare forms that align with the letter of the law.

These disclosure and consent forms serve to make a background check FCRA-compliant. These forms also give the background screening company permission to perform the check. They may also serve as verification to former employers or schools that they may share background information.

To better understand why FCRA compliance matters, read this article about enforcement actions in 2023. The Federal Trade Commission found two California companies violated the law. The FTC uncovered “willful” violations of the FCRA and fined the businesses millions of dollars. As we can see, noncompliance can prove costly.

These rules don’t just apply to criminal history checks. In any situation where backgroundchecks.com obtains information based on an interview, you must provide additional disclosures. For example, what you must disclose to conduct reference or employment checks.

You must inform the subject that you’re obtaining a consumer report about them. This report may contain information about their character, personal characteristics, or mode of living.

You must inform the subject that they have a right to request a description of the nature and scope of the investigation. If the subject requests that description, you must provide it within five days.

If a background check returns no red flags, the employer may choose to move forward with hiring the subject of that report. In these situations, the employer has no more remaining obligations under the FCRA.

However, what if the employer rescinds a job offer or disqualifies a candidate? If they base the decision on background check findings, additional FCRA requirements apply. In the parlance of the FCRA, this decision is “adverse action.” Employers considering adverse action based on a background check face more FCRA obligations. You must complete these obligations before dismissing an applicant.

The FCRA requires you to send the candidate a “pre-adverse-action notice” before you finalize your decision. The pre-adverse action notice must include a copy of the background report you used. It must also have the Consumer Financial Protection Bureau’s summary of rights.

You must send this pre-adverse notice a “reasonable time” before making the final decision. The FTC states that five business days is a reasonable time to give notice by mail. If that time elapses without a response, you may proceed with the adverse decision.

If the subject disputes the background report, you must halt the hiring process. Under the FCRA, you cannot take final adverse action until after the background check company resolves the dispute.

If the subject does not respond, you can officially take action and move forward with the hiring process. Similarly, a dispute may be resolved in your favor. The background check company may rule that the information in the report is accurate. If so, you can formally take the candidate out of employment consideration.

When you take action based on a background check, some other steps are necessary to comply. These steps include the following:

Notify the subject of the decision.

Provide the background check company’s business name, address, and contact info.

Notify the subject that the background check company did not make the decision.

Notify the subject that they can request another free copy of their background report. They must request the report from the background check provider within the next 62 days.

Notify the subject that they can dispute any inaccurate or incomplete information in the report. To do so, they must contact the background screening agency.

Many states also have extra requirements concerning using a background check company’s services. States such as California require additional notices and steps. Always review the law in your local area before using background checks.

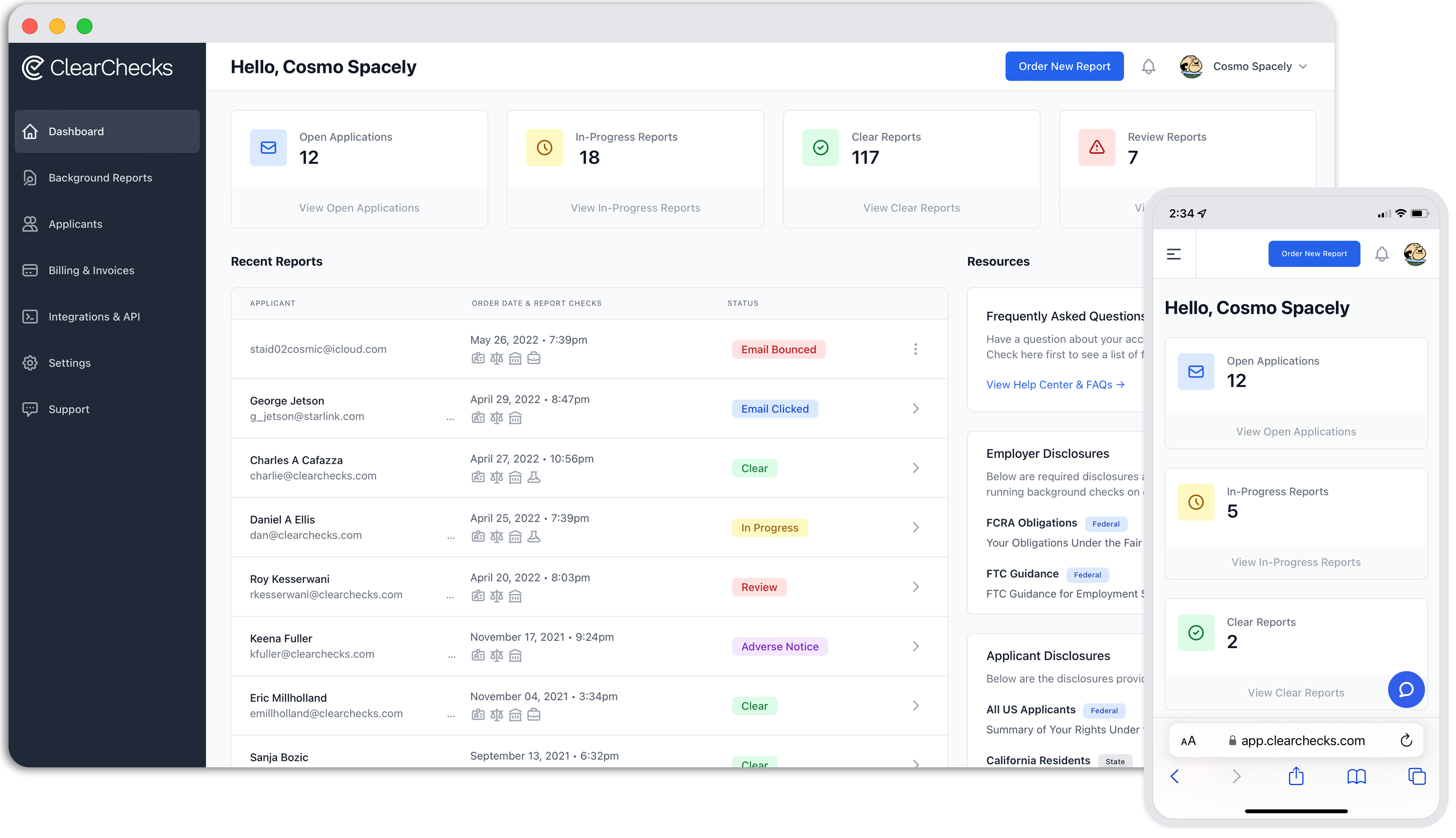

backgroundchecks.com provides forms online and assists you with compliance

At backgroundchecks.com, our customers can access a dedicated compliance area in our web-based order system. The following FCRA compliance support is available through that system:

Sample pre-adverse action notices

Sample adverse action notices

An overview of the Driver’s Privacy Protection Act of 1994, which impacts the use of motor vehicle reports in consumer investigation.

backgroundchecks.com can help with electronic pre-adverse and adverse action services

If you want us to handle this process, you will only have to provide the applicant’s email address during the order process. The video will give you a quick overview of the process.

Need Background Checks?

See packages and pricing and order instantly.

National, County, Statewide, Federal Criminal Searches

Motor Vehicle Records

Employment & Education Verifications

Bankruptcies, Liens, & Judgments

Drug Testing

TruthFinder Review: The Real Risks of Using People-Search Sites

BeenVerified Review: What “Been Verified” Really Means (and What It Doesn’t)

Scaling Starts with People: How McDonald’s Develops Talent and High-Performing Franchise Operators

Keeping Volunteer Organizations Safe During the Holiday Season

Why We Require Social Security Numbers: A Case for Accuracy in Background Checks

A Note from ClearChecks on HireRight Acquisition & New BackgroundChecks.com