May 16th, 2013

It’s a shocking statistic, but the facts make it clear: many of the biggest financial threats to a business come from within. An in-depth study by an American insurer revealed that among companies that experienced significant losses from theft, approximately 90% originated with employees. Could an employment credit check prevent some of those losses? According to an FBI study, nearly two-thirds of employees would consider stealing from a business if they could do so without risk. These numbers illustrate that a thorough background and credit check procedure may be necessary.

The problem isn’t new. In 2012, a private investigative firm studied hundreds of significant business embezzlement cases. The study found an average loss of $1.4 million and, in a surprising twist, fewer than 5% of predominant theft cases involved people with a criminal record. That poses a problem for business owners trying to manage risks. Combining a report on someone’s credit and a background check could offer more details.

In a background check, red flags may include prior convictions for theft or robbery. Someone may even have received a conviction for fraud or embezzlement in the past. However, as studies have shown, most who steal haven’t committed a crime before. Stealing from one’s employer is often a crime of opportunity that can become habitual.

In a 2019 survey by the insurer Hiscox, 85% of embezzlement was committed by managers. Nearly a third of the perpetrators worked in financial roles or within the accounting department. Employers seeking to prevent embezzlement and fraud should focus on those job categories at the highest risk level. A credit history report for an overnight stock clerk at a grocery store is likely irrelevant. However, these tools can prove very useful for the manager responsible for daily cash deposits.

Reviewing an applicant’s credit report can reveal important details to indicate that someone may be tempted to steal. Among the most common red flags for potential employee theft, 26% of offenders had financial difficulties, and 42% lived beyond their means. Beyond credit scores, reports offer information that can signal these risks in an applicant’s background.

Most employers won’t reject applicants merely because they have a low credit score. However, a high credit card debt load could indicate that an applicant has severe financial pressure. A history of missed payments or accounts sent to collections is also a red flag for jobs that involve access to business funds or cash. If an employer spots too many of these warnings, bad credit could result in rescinding a job offer. The employer must follow the Fair Credit Reporting Act’s (FCRA) adverse action process, which involves notification and the opportunity for an applicant to dispute your findings.

It is not always legal for employers to consider credit reports when hiring. Nearly a dozen states have enacted restrictions on using credit data for hiring. That list includes major economies, such as the state of California. You should know the existing limitations before incorporating credit checks into your process. Sometimes, you may not be able to use them at all.

In others, the laws of these states make exceptions for positions where financial risks are a more significant concern. These exceptions often include management positions, jobs with salaries over $75,000, or direct access to cash or business accounts. Before you start requiring applicants to submit to a credit check, confirm the laws in your area. Don’t forget to brush up on (FCRA) requirements, which apply equally to background and credit checks.

In 2024, South Dakota announced it would charge a Department of Social Services employee with embezzlement. Over a nearly 15-year period, the employee stole approximately $1.8 million by abusing her position within the state foster care system. The details of this case highlight the importance of proactively combating fraud. Even with a background check and a credit check, the state might not have detected the risk of fraud. The woman had no convictions and worked for many years before embezzling funds.

How could she steal so much without any prior warning signs? The answer is simple: poor governance and oversight. The woman had attained a position within the Department of Social Services that gave her an exceedingly high level of authority. She could issue item requisition requests and approve the payment herself. It was then a simple matter of intercepting the check and taking the money for herself while marking the bogus request as fulfilled.

This is an excellent example of how a background and credit check for employment aren’t enough in isolation to prevent fraud. Both tools are handy for determining when someone might be at high risk for financial crime. However, many embezzlement cases are crimes of opportunity rather than obvious need. Businesses should think carefully about who has the authority to tap the company’s funds. Additional oversight and approval is essential.

Big businesses aren’t the only ones with concerns about theft and embezzlement. Even a small business or non-profit must be vigilant against these threats. Using every tool at your disposal to spot red flags is essential. Though you can’t eliminate every avenue of risk before hiring, you can manage that risk and reduce threats to your business. The right tools make the difference.

Where it is legal for your business to do so, an employment credit check can improve your evaluation of candidates. A thorough background and credit check may reveal past fraud convictions, a high level of financial pressure and other possible warning signs. At backgroundchecks.com, we make these solutions accessible and easy to use across different levels of need. Learn more about these reporting products and explore additional facts in our Resource Center.

Need Background Checks?

See packages and pricing and order instantly.

National, County, Statewide, Federal Criminal Searches

Motor Vehicle Records

Employment & Education Verifications

Bankruptcies, Liens, & Judgments

Drug Testing

Hospitality Hiring Guide: Background Checks for Hotels & Restaurants

TruthFinder Review: The Real Risks of Using People-Search Sites

BeenVerified Review: What “Been Verified” Really Means (and What It Doesn’t)

Scaling Starts with People: How McDonald’s Develops Talent and High-Performing Franchise Operators

Keeping Volunteer Organizations Safe During the Holiday Season

Why We Require Social Security Numbers: A Case for Accuracy in Background Checks

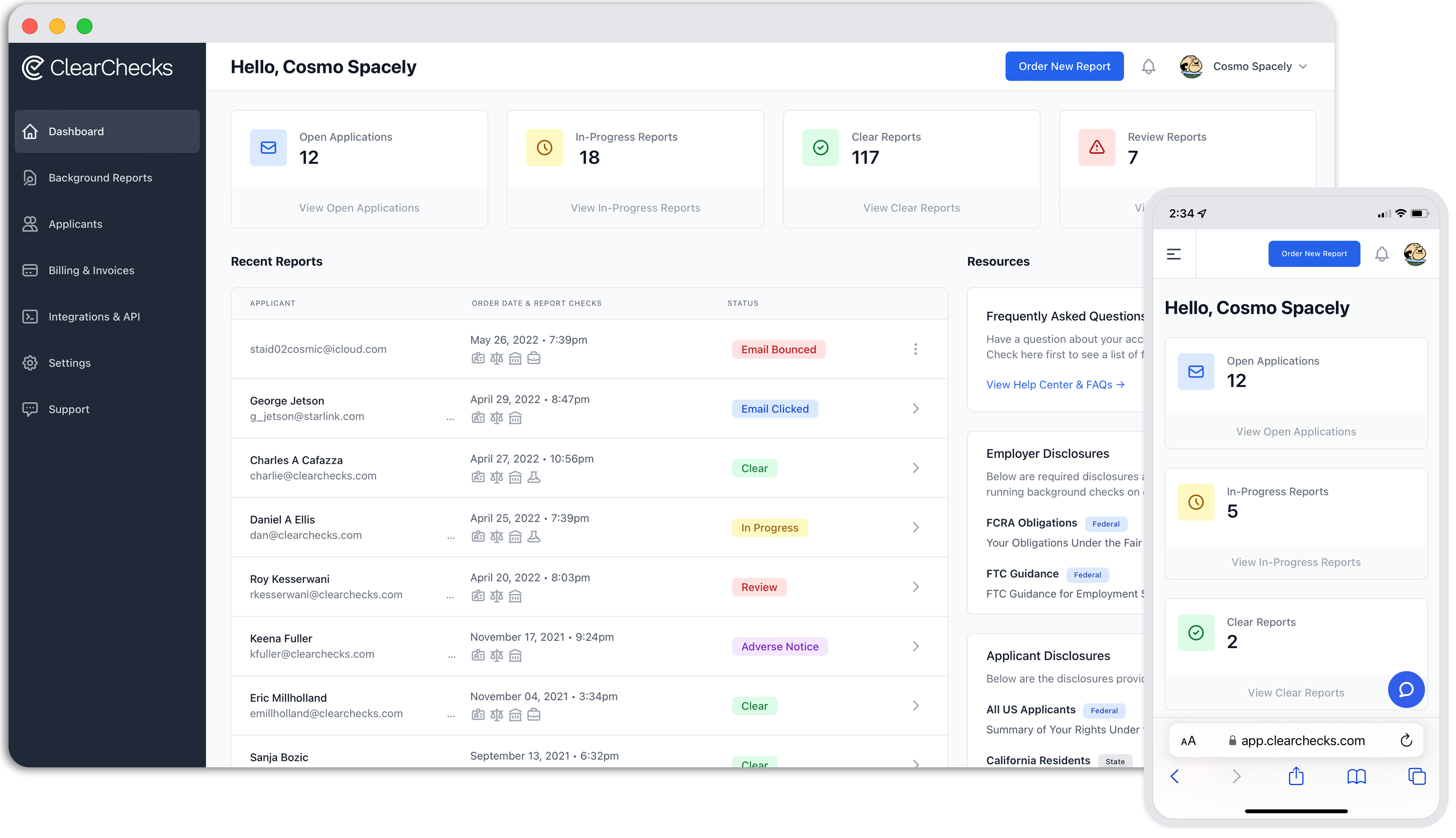

A Note from ClearChecks on HireRight Acquisition & New BackgroundChecks.com