NEWS

Insights & Resources for Employers

Keep up with latest news and trends with HR compliance

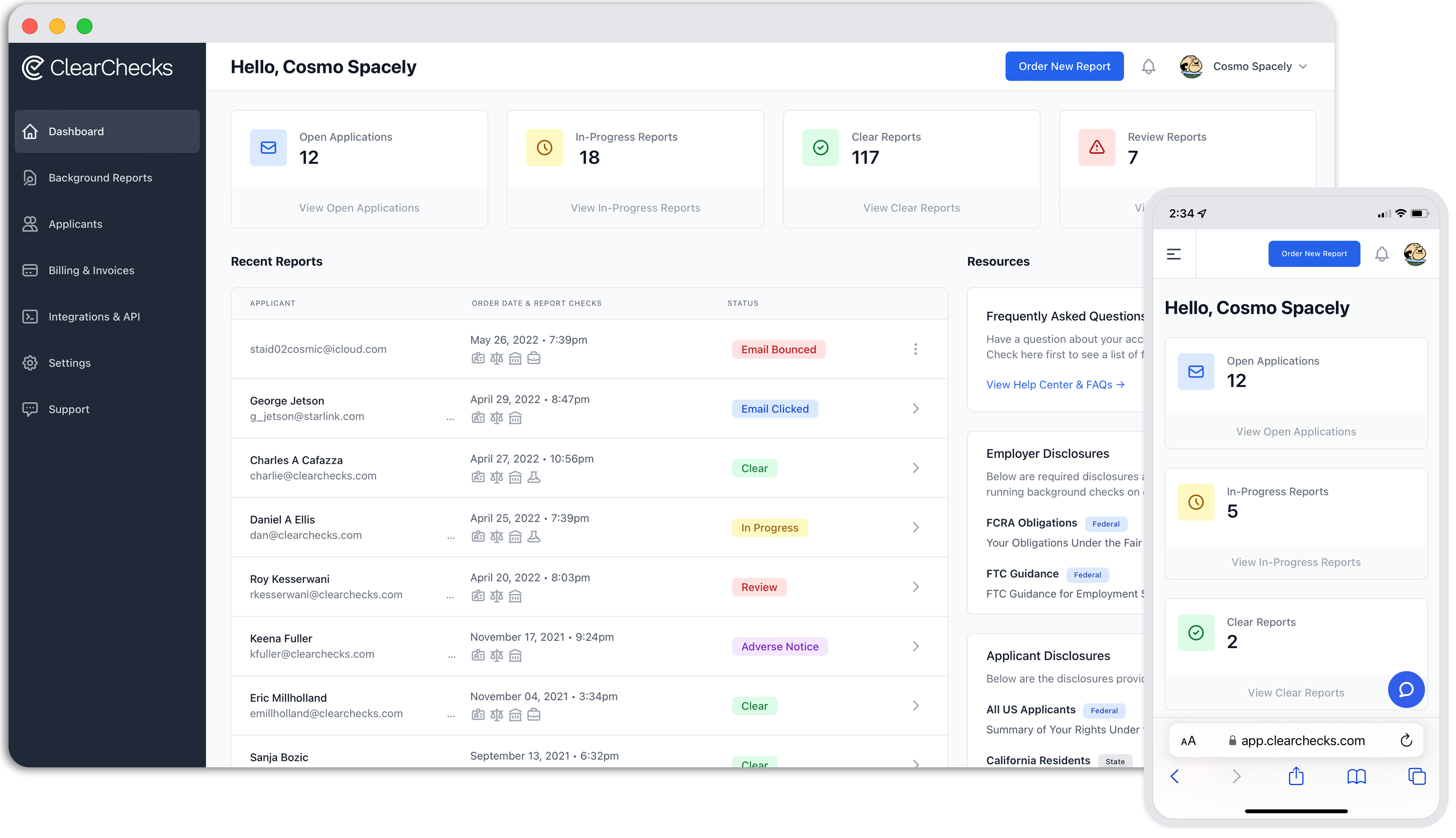

Need Background Checks?

See packages and pricing and order instantly.

National, County, Statewide, Federal Criminal Searches

Motor Vehicle Records

Employment & Education Verifications

Bankruptcies, Liens, & Judgments

Drug Testing

Scaling Starts with People: How McDonald’s Develops Talent and High-Performing Franchise Operators

Keeping Volunteer Organizations Safe During the Holiday Season

Why We Require Social Security Numbers: A Case for Accuracy in Background Checks

A Note from ClearChecks on HireRight Acquisition & New BackgroundChecks.com